One-Click to Asset Multiplication

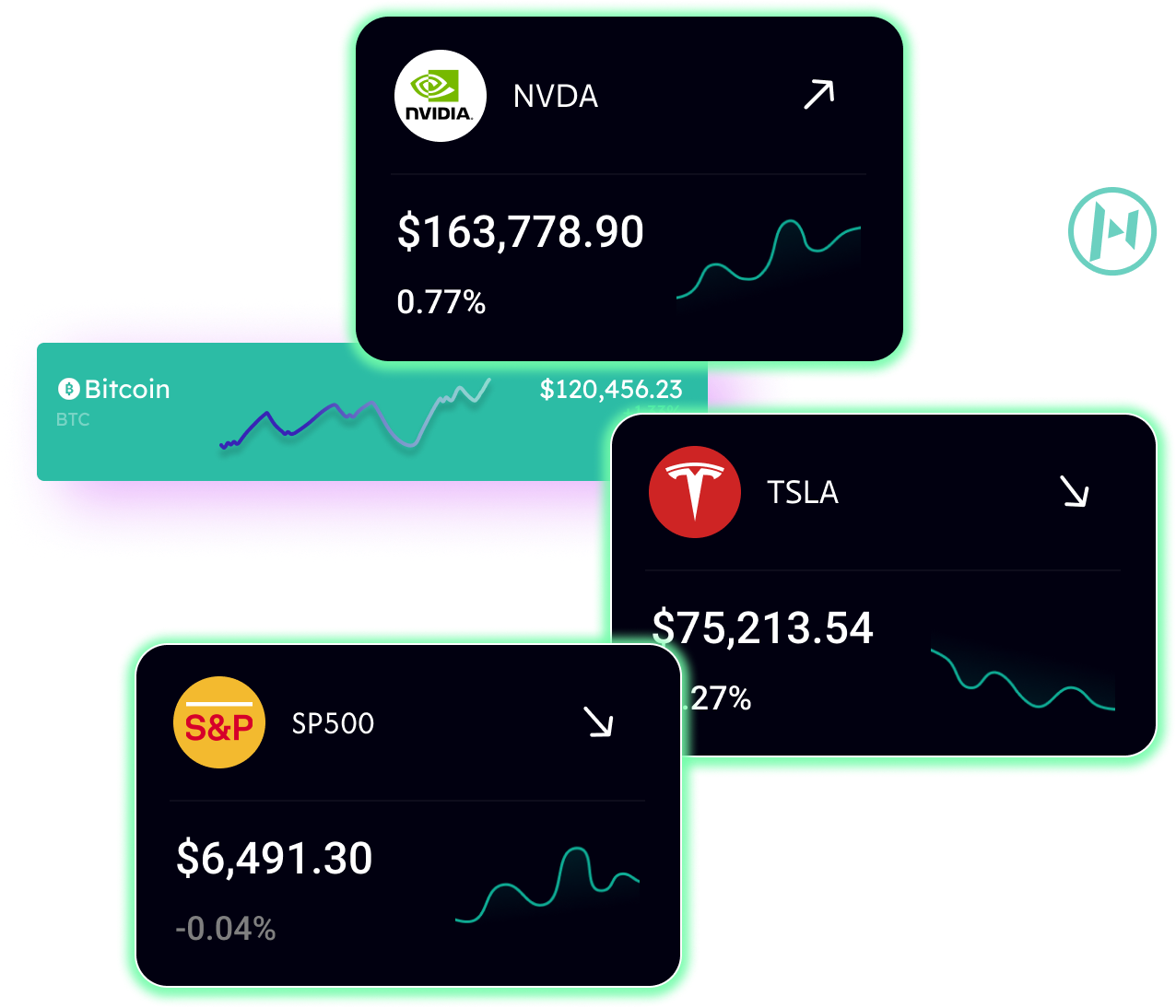

With State-of-the-art Algo

trading services by Alvia

Discover a smart way to manage and boost your wealth

effortlessly for 24/7, across forex, and crypto markets

Please fill in the correct contact details

One-Click to Asset

Multiplication

With State-of-the-art Algo trading

services by Alvia

Discover a smart way to manage and boost your

wealth effortlessly for 24/7, across forex, and

crypto markets

Please fill in the correct contact details

Traders, ENTREPRENEURS, investors from 27 countries around the world

Have trusted Alvia team in managing

their wealth multiplication!

Whatever goals you set for your capital, it is critically important to have a reliable contractor with whom it is easy and secure to move forward in the long term.

Traders, ENTREPRENEURS, investors from 27 countries around the world

Have trusted Alvia team in managing

their wealth multiplication!

Whatever goals you set for your capital, it is critically important to have a reliable contractor with whom it is easy and secure to move forward in the long term.

Traders, ENTREPRENEURS, investors from

27 countries around the world

Have trusted Alvia team in

managing their wealth

multiplication!

Whatever goals you set for your capital, it is critically important to have a reliable contractor with whom

it is easy and secure to move forward in the long term.

Increase and preserve your wealth

Seamless capital growth through

algorithmic precision

Alvia - a trusted partner in building reliable and scalable passive income through innovative algorithmic

trading solutions. We empower individuals and businesses to achieve financial freedom, providing a

smart, flexible, and risk-adjusted approach to wealth growth in any market condition.

Increase and preserve your wealth

Seamless capital growth

through algorithmic

precision

Alvia - a trusted partner in building reliable and

scalable passive income through innovative

algorithmic trading solutions. We empower

individuals and businesses to achieve financial

freedom, providing a smart, flexible, and risk-

adjusted approach to wealth growth in any market

condition.

What is Alvia?

Finding alpha is a challenging task. Our trading team brings together advanced algorithmic systems and expert-driven oversight to provide the market with a hi-end robust capital management solution that aligns with a huge demand for investment tools, while remaining sustainable in a highly compressed market.

Designed for individuals and institutions seeking reliability, liquidity, and consistent growth, our approach transforms complex markets into accessible and lucrative opportunities.

8+

simultaneously running strategies

(*including both algos and DeFi instruments)

2+

years of profitable consulting

(*API trading & portfolio management)

124%

total deposit growth from 2023

(*who use algos more than 12 months)

What is Alvia?

Finding alpha is a challenging task. Our trading team brings together advanced algorithmic systems and expert-driven oversight to provide the market with a hi-end robust capital management solution that aligns with a huge demand for investment tools, while remaining sustainable in a highly compressed market.

Designed for individuals and institutions seeking reliability, liquidity, and consistent growth, our approach transforms complex markets into accessible and lucrative opportunities.

8+

simultaneously running strategies

(*including both algos and DeFi instruments)

2+

years of profitable consulting

(*API trading & portfolio management)

124%

total deposit growth from 2023

(*who use algos more than 12 months)

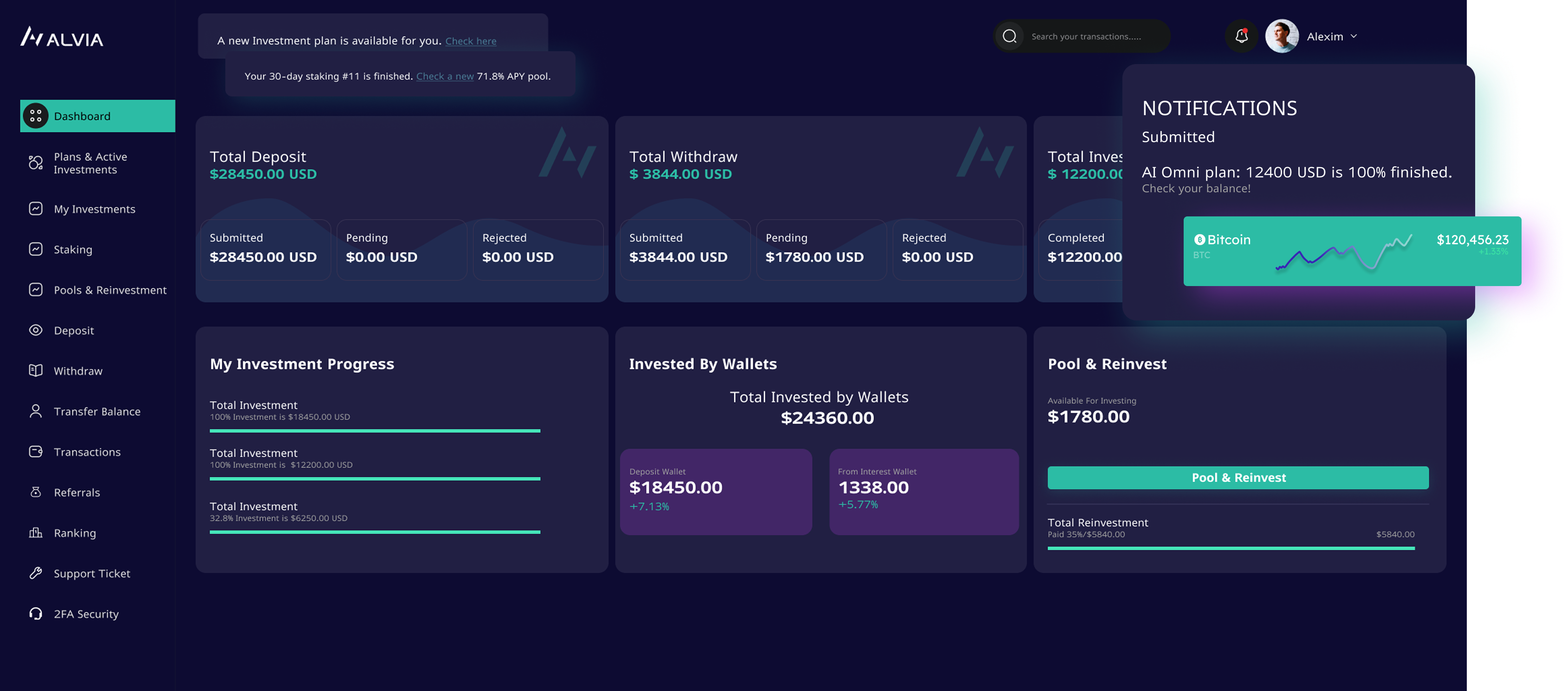

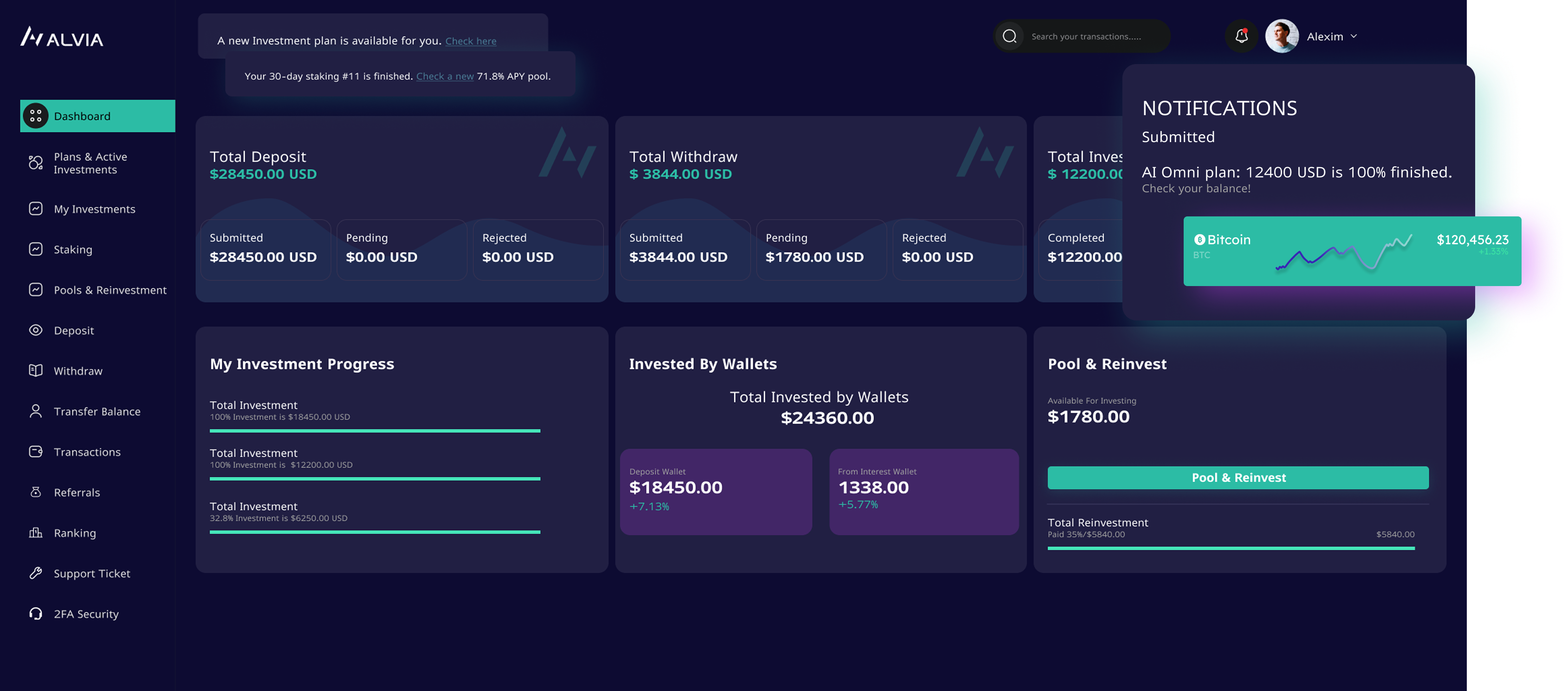

How does the Alvia work?

Designed for Visionaries.

Built to preserve, grow, and diversify your wealth across global markets.

Choose the Plan

Select the investment strategy based on your preferred APR and risk profile.

Each Plan is aligned with specific temporary drawdown limits, and a guaranteed safeVault hedge option, providing you a variety of differently pre-set strategies to make a more tailored choice up to your investment preferences.

Connection Process

In your personal account, choose your preferred deposit method and network.

Our team then applies the settings of your selected plan to your newly created trading sub-account on the Alvia platform.

Onboarding & Setups

Once the funds are deposited, our algorithms will automatically rebalance your portfolio, and split the use of the deposit to different strategies and timeframes, adjusting for different asset classes according to the chosen risk profile.

How does the Alvia work?

Designed for Visionaries.

Built to preserve, grow, and diversify your wealth across global markets.

Select the investment strategy based on your preferred APR and risk profile.

Each Plan is aligned with specific temporary drawdown limits, and a guaranteed safeVault hedge option, providing you a variety of differently pre-set strategies to make a more tailored choice up to your investment preferences.

In your personal account, choose your preferred deposit method and network.

Our team then applies the settings of your selected plan to your newly created trading sub-account on the Alvia platform.

Once the funds are deposited, our algorithms will automatically rebalance your portfolio, and split the use of the deposit to different strategies and timeframes, adjusting for different asset classes according to the chosen risk profile.

How does the Alvia work?

Designed for Visionaries.

Built to preserve, grow, and diversify your wealth across global markets.

Choose the Plan

Select the investment strategy based on your preferred APR and risk profile.

Each Plan is aligned with specific temporary drawdown limits, and a guaranteed safeVault hedge option, providing you a variety of differently pre-set strategies to make a more tailored choice up to your investment preferences.

Connection Process

In your personal account, choose your preferred deposit method and network.

Our team then applies the settings of your selected plan to your newly created trading sub-account on the Alvia platform.

Onboarding & Setups

Once the funds are deposited, our algorithms will automatically rebalance your portfolio, and split the use of the deposit to different strategies and timeframes, adjusting for different asset classes according to the chosen risk profile.

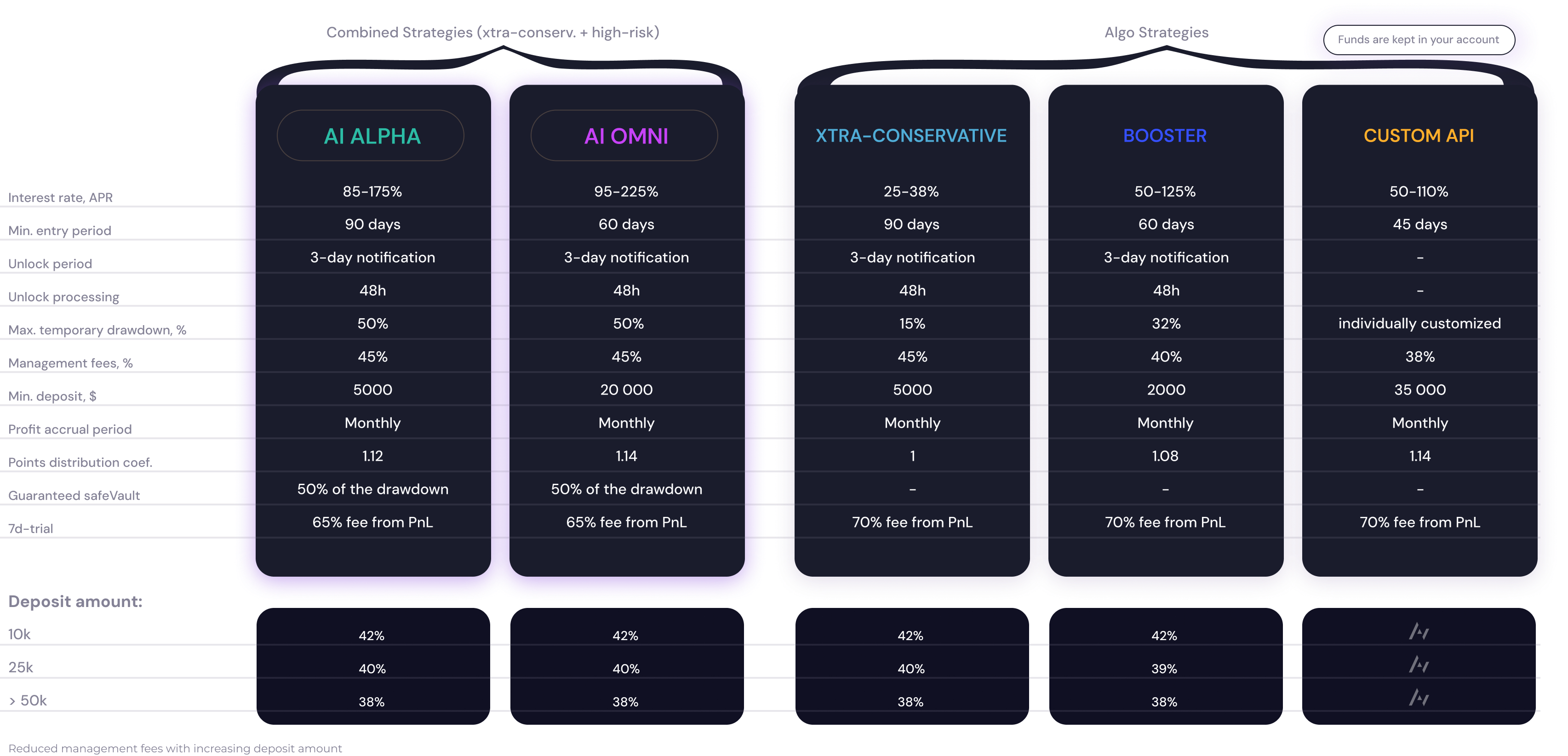

Choose the best way to expand

your financial freedom

Designed to provide maximum return on your capital.

Choose the best way to expand

your financial freedom

Designed to provide maximum return on your capital.

Why to choose the Algo copy

trading services by Alvia?

Designed to expand your financial potential.

Expert Insights,

Adaptive Strategies

Alvia’s in-house team of analysts and professional traders ensures our algorithms evolve with market conditions. By closely monitoring market shifts, sentiment changes, and external factors, we adapt our strategies in real-time to avoid misalignment during trend reversals. This dynamic approach helps us capitalize on market narratives, whatever direction they take.

Capital Protection

with SafeVault

Our Guaranteed SafeVault option provides a layer of protection, ensuring clients are compensated for temporary drawdowns if their capital is exposed to a loss at the end of the deposit period. Although instances of customers exiting the product hitting periods of drawdowns are rare, this feature underscores our commitment to capital preservation and a responsible partnership with our investors.

Multi-Strategy

Layering for Stability

By simultaneously deploying multiple strategies, also among different asset classes, we reduce the impact of sudden market volatility on the balance of the portfolio. This layering approach provides higher consistency over time, while balancing risk across different asset types, improving overall safety when positions are hedged effectively.

Customized Strategies

for High-Value Clients

For investors with capital over $50k, we offer personalized risk-profile strategies tailored to meet specific financial goals. This customization provides both flexibility and security, enabling corporate clients and serial investors to target medium- and large-scale investment objectives with precision and comfort.

Why to choose the Algo copy

trading services by Alvia?

Designed to expand your financial potential.

Expert Insights,

Adaptive Strategies

Alvia’s in-house team of analysts and professional traders ensures our algorithms evolve with market conditions. By closely monitoring market shifts, sentiment changes, and external factors, we adapt our strategies in real-time to avoid misalignment during trend reversals. This dynamic approach helps us capitalize on market narratives, whatever direction they take.

Capital Protection

with SafeVault

Our Guaranteed SafeVault option provides a layer of protection, ensuring clients are compensated for temporary drawdowns if their capital is exposed to a loss at the end of the deposit period. Although instances of customers exiting the product hitting periods of drawdowns are rare, this feature underscores our commitment to capital preservation and a responsible partnership with our investors.

Multi-Strategy

Layering for Stability

By simultaneously deploying multiple strategies, also among different asset classes, we reduce the impact of sudden market volatility on the balance of the portfolio. This layering approach provides higher consistency over time, while balancing risk across different asset types, improving overall safety when positions are hedged effectively.

Customized Strategies

for High-Value Clients

For investors with capital over $50k, we offer personalized risk-profile strategies tailored to meet specific financial goals. This customization provides both flexibility and security, enabling corporate clients and serial investors to target medium- and large-scale investment objectives with precision and comfort.

Increase and preserve your wealth

Join us today and start making money with Algo

trading services by Alvia

Take a leverage on your capital multiplication with proven algo trading strategies, designed to deliver

consistent and compounding returns in any market conditions.

Increase and preserve your wealth

Join us today and start making money with Algo

trading services by Alvia

Take a leverage on your capital multiplication with proven algo trading strategies, designed to deliver consistent and compounding returns in any market conditions.

We provide our clients with tailored solutions to achieve their financial goals.

We provide our clients with

tailored solutions to achieve

their financial goals.

We provide our clients with tailored solutions to achieve their financial goals, whether focused on capital growth or preservation, offering a comprehensive range of strategies to meet diverse objectives.

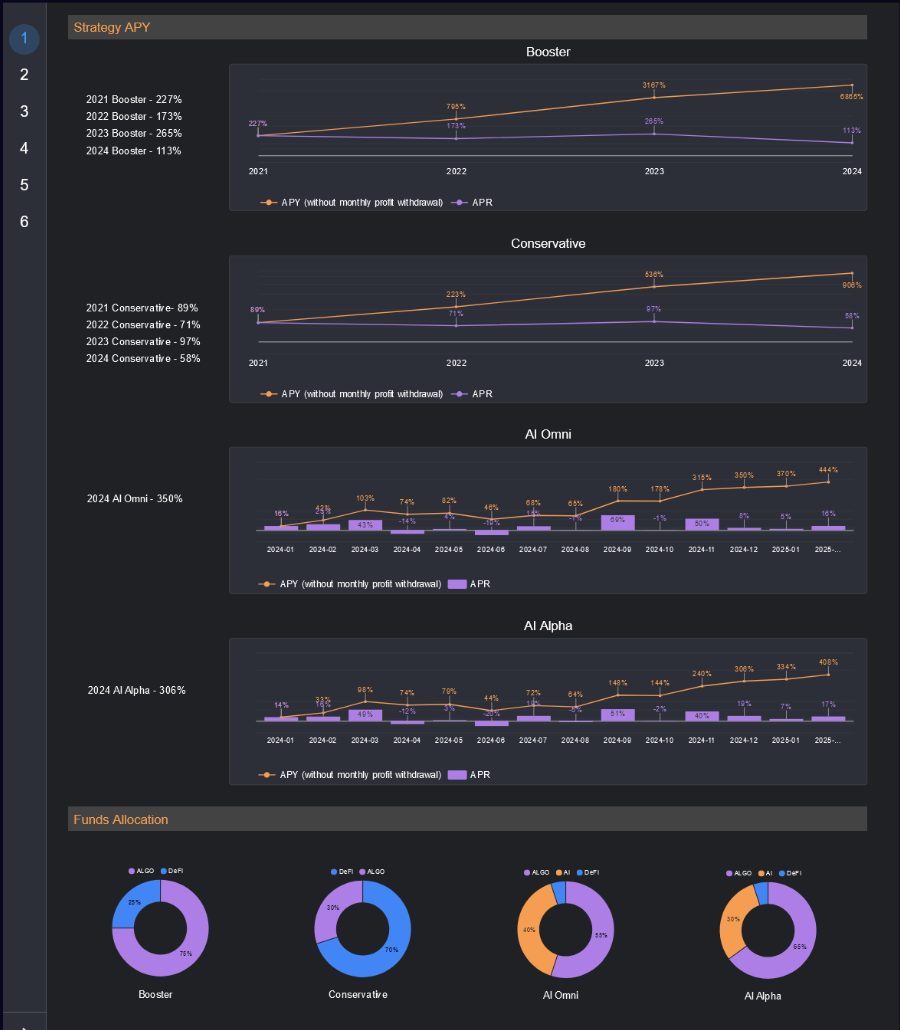

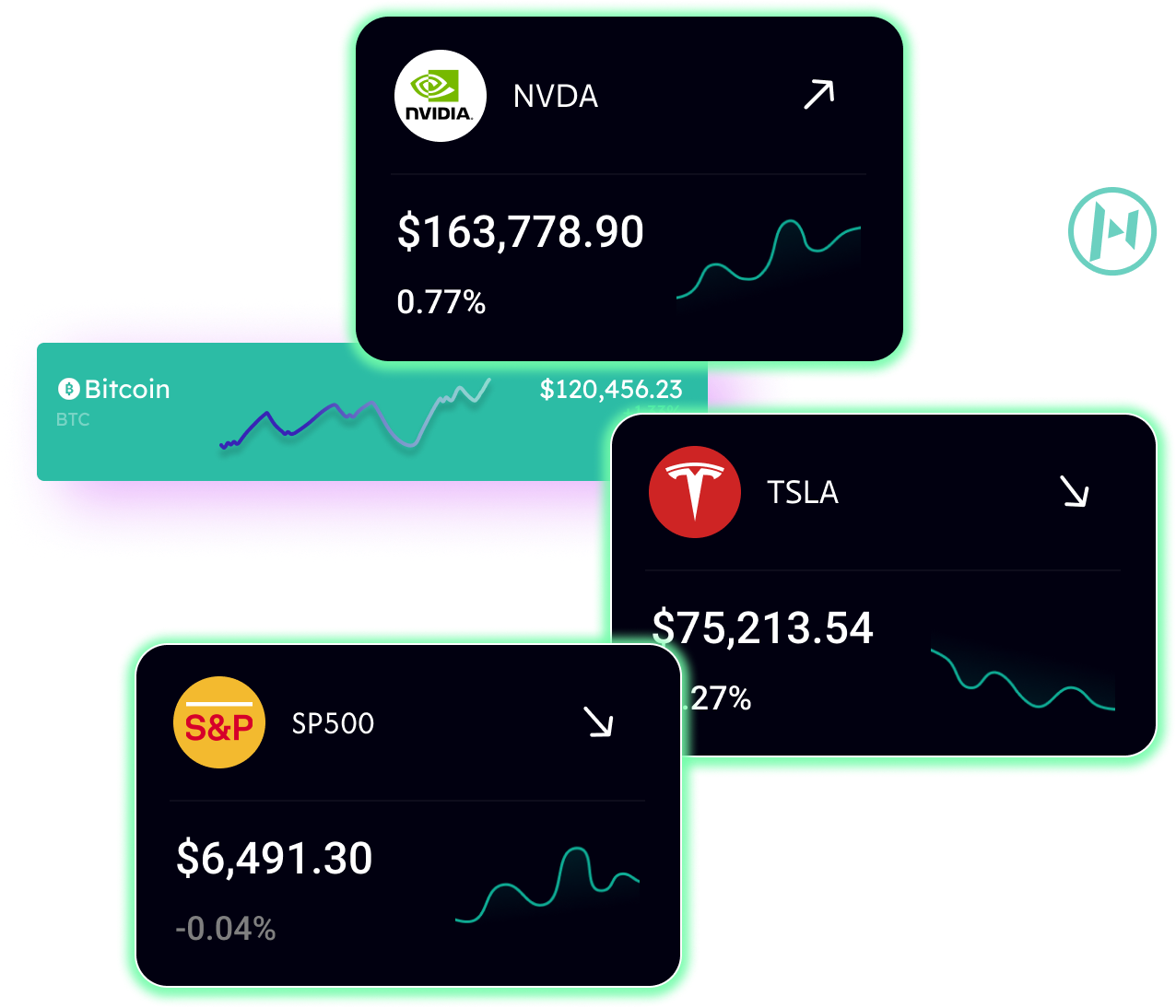

Performance overview

Whether focused on capital growth or preservation, offering a comprehensive range of strategies to meet diverse objectives.

- The performance of each presented strategy is based on a total of 12+ instruments across different platforms and markets.

- The statistics reflect only the results of retail investors (Corporate & High Net Worth clients are not included, as cooperation with any funds is under NDA and involves individual strategies).

- Past performance does not guarantee future results. Markets are dynamic and constantly changing.

Performance overview

Whether focused on capital growth or preservation, offering a comprehensive range of strategies

to meet diverse objectives.

- The performance of each presented strategy is based on a total of 12+ instruments across different platforms and markets.

-The statistics reflect only the results of retail investors (Corporate & High Net Worth clients are not included, as cooperation with any funds is under NDA and involves individual strategies).

-Past performance does not guarantee future results. Markets are dynamic and constantly changing.

Complete simple tasks by expanding your network, and multiplying your passive income!

Complete simple tasks by expanding your network, and multiplying your passive income!

FAQ

Alvia operates with full transparency, leveraging over 12 years of proven trading strategies. Our team consists of seasoned analysts and traders, using proprietary algorithms to deliver stable and consistent results.

Our algorithms are designed to adapt dynamically to market conditions, incorporating hedging strategies and diversified asset allocations, including both crypto (BTC and SOL) and assets from TradFi like XAU, JPY, and GBP. This ensures we can generate returns even during periods of market uncertainty or downturns.

As a strong evidence of consistency would be that during the bear cycle in the crypto market from early 2022 to mid 2024, our strategies made the following results:

2022 - 843% APR; 2023 - 561% APR; 2024 - 807% APR.

Alvia’s edge lies in its tailored approach to portfolio composition and strategy design. Each strategy is customized to specific asset classes, accounting for their unique market behaviors and volatility profiles. Unlike other teams, our portfolios are diversified across multiple asset types, ensuring overlapping performance periods to hedge risks effectively between open strategies. Additionally, all algorithms are dynamically adjusted for various timeframes, optimizing performance based on the asset's characteristics and market conditions.

This multi-layered, adaptive framework sets Alvia apart, providing a robust balance of risk mitigation and consistent returns regardless of market conditions.

Alvia’s team utilizes a sophisticated approach, rooted in mathematical models refined through years of professional trading experience. Unlike conventional strategies that focus on visible price patterns, our methods analyze the liquidity dynamics, price movement logic, and underlying energy of assets. This allows for seamless adaptation to market shifts and ensures that every trade is guided by robust data-driven insights. By removing the influence of human emotions and subjective errors, we deliver a level of stability and performance rarely achievable through traditional or less advanced systems.

Strict adherence to risk management: no more than 0.35% risk in a single trade, with the total amount of open positions not exceeding 10% of the capital.

Alvia differs fundamentally from standard copy trading. While exchange-based copy trading merely replicates the trades of selected individuals, Alvia’s strategies are powered by advanced mathematical models and professional algorithms designed to adapt dynamically to market conditions. Our approach eliminates the reliance on individual decision-making, which can be inconsistent or influenced by emotions, and instead leverages systematic, data-driven methodologies. This ensures a more reliable, scalable, and optimized investment process, far beyond what traditional copy trading offers.

Alvia bridges the gap between institutional-grade trading solutions and accessibility for retail investors. Historically, such advanced algorithmic strategies were reserved for high-net-worth individuals or institutions with substantial capital. However, Alvia has tailored its service to allow retail investors to benefit from the same level of expertise and sophistication at a more accessible entry point. This democratization of high-performance trading solutions, combined with our innovative methods and competitive pricing, makes Alvia a one-of-a-kind opportunity in the market.

The minimum capital requirement depends on the selected plan, starting from $1,000. For larger investments (from $25k), we offer customized strategies to align with specific financial goals and risk exposure.

Our strategies are tailored to different risk levels, from conservative to high-yield distinguishing with a maximum drawdown. Each is rigorously tested to ensure resilience in volatile markets, with diversified assets and hedging to minimize drawdowns while focusing on stable, long-term growth.

Alvia provides a unique combination of high-performance returns, flexible access to liquidity, and diversification opportunities, making it an ideal complement to existing investment strategies. With a portfolio that includes multiple asset classes and strategies, we offer the ability to capture gains across various market conditions, while reducing overall risk. Managed by a professional team of analysts and traders, Alvia ensures a level of oversight and expertise that outperforms many conventional investment tools. This makes it not only a profitable option but also a strategic one for enhancing capital growth.

Alvia provides investors with a comprehensive solution that goes beyond simple algorithmic trading. Our platform offers intelligent diversification across multiple asset classes, such as crypto, forex, and others, allowing investors to spread risk and optimize returns in various market conditions. This diversification is key for hedging against inflation, currency devaluation, or downturns in specific sectors, ensuring stable portfolio growth despite external economic pressures.

If depositing from $25k you will keep the whole control over your funds. The funds will be stored right on your CEX, on a separate subaccount you will be asked to create. We will only have access to using your funds for trades. Meanwhile, you will be able to withdraw the funds that are not being used at the moment at any time.

If depositing from $25k you will the funds will be stored on your CEX, so you will be able to withdraw the funds with the end of your Plan period.

If depositing less than $25k a deposit will terminate automatically with the end of your Plan period. Until that time, the funds are held in a trading pool, with no optional early withdrawal.

Simply sign up on our platform (app.alvia.pro), select a Plan, and make a deposit of the desired amount in your account via the appropriate payment method.

You`ll find the onboarding videos while start your registration on the platform.

Trading and management commissions are specified in the pricing plans and will decrease as your trading deposit increases.

Yes, for investments over $50,000, we offer personalized strategies tailored to your risk tolerance and individual financial objectives.

While success varies by strategy and market conditions, Alvia’s historical data demonstrates consistent profitability with a track record of outperforming benchmarks.

You can get in touch with our team via the contact form on its website or just text us at support@alvia.com

FAQ

Alvia operates with full transparency, leveraging over 12 years of proven trading strategies. Our team consists of seasoned analysts and traders, using proprietary algorithms to deliver stable and consistent results.

Our algorithms are designed to adapt dynamically to market conditions, incorporating hedging strategies and diversified asset allocations, including both crypto (BTC and SOL) and assets from TradFi like XAU, JPY, and GBP. This ensures we can generate returns even during periods of market uncertainty or downturns.

As a strong evidence of consistency would be that during the bear cycle in the crypto market from early 2022 to mid 2024, our strategies made the following results:

2022 - 843% APR; 2023 - 561% APR; 2024 - 807% APR.

Alvia’s edge lies in its tailored approach to portfolio composition and strategy design. Each strategy is customized to specific asset classes, accounting for their unique market behaviors and volatility profiles. Unlike other teams, our portfolios are diversified across multiple asset types, ensuring overlapping performance periods to hedge risks effectively between open strategies. Additionally, all algorithms are dynamically adjusted for various timeframes, optimizing performance based on the asset's characteristics and market conditions.

This multi-layered, adaptive framework sets Alvia apart, providing a robust balance of risk mitigation and consistent returns regardless of market conditions.

Alvia’s team utilizes a sophisticated approach, rooted in mathematical models refined through years of professional trading experience. Unlike conventional strategies that focus on visible price patterns, our methods analyze the liquidity dynamics, price movement logic, and underlying energy of assets. This allows for seamless adaptation to market shifts and ensures that every trade is guided by robust data-driven insights. By removing the influence of human emotions and subjective errors, we deliver a level of stability and performance rarely achievable through traditional or less advanced systems.

Strict adherence to risk management: no more than 0.35% risk in a single trade, with the total amount of open positions not exceeding 10% of the capital.

Alvia differs fundamentally from standard copy trading. While exchange-based copy trading merely replicates the trades of selected individuals, Alvia’s strategies are powered by advanced mathematical models and professional algorithms designed to adapt dynamically to market conditions. Our approach eliminates the reliance on individual decision-making, which can be inconsistent or influenced by emotions, and instead leverages systematic, data-driven methodologies. This ensures a more reliable, scalable, and optimized investment process, far beyond what traditional copy trading offers.

Alvia bridges the gap between institutional-grade trading solutions and accessibility for retail investors. Historically, such advanced algorithmic strategies were reserved for high-net-worth individuals or institutions with substantial capital. However, Alvia has tailored its service to allow retail investors to benefit from the same level of expertise and sophistication at a more accessible entry point. This democratization of high-performance trading solutions, combined with our innovative methods and competitive pricing, makes Alvia a one-of-a-kind opportunity in the market.

The minimum capital requirement depends on the selected plan, starting from $1,000. For larger investments (from $25k), we offer customized strategies to align with specific financial goals and risk exposure.

Our strategies are tailored to different risk levels, from conservative to high-yield distinguishing with a maximum drawdown. Each is rigorously tested to ensure resilience in volatile markets, with diversified assets and hedging to minimize drawdowns while focusing on stable, long-term growth.

Alvia provides a unique combination of high-performance returns, flexible access to liquidity, and diversification opportunities, making it an ideal complement to existing investment strategies. With a portfolio that includes multiple asset classes and strategies, we offer the ability to capture gains across various market conditions, while reducing overall risk. Managed by a professional team of analysts and traders, Alvia ensures a level of oversight and expertise that outperforms many conventional investment tools. This makes it not only a profitable option but also a strategic one for enhancing capital growth.

Alvia provides investors with a comprehensive solution that goes beyond simple algorithmic trading. Our platform offers intelligent diversification across multiple asset classes, such as crypto, forex, and others, allowing investors to spread risk and optimize returns in various market conditions. This diversification is key for hedging against inflation, currency devaluation, or downturns in specific sectors, ensuring stable portfolio growth despite external economic pressures.

If depositing from $25k you will keep the whole control over your funds. The funds will be stored right on your CEX, on a separate subaccount you will be asked to create. We will only have access to using your funds for trades. Meanwhile, you will be able to withdraw the funds that are not being used at the moment at any time.

If depositing from $25k you will the funds will be stored on your CEX, so you will be able to withdraw the funds with the end of your Plan period.

If depositing less than $25k a deposit will terminate automatically with the end of your Plan period. Until that time, the funds are held in a trading pool, with no optional early withdrawal.

Simply sign up on our platform (app.alvia.pro), select a Plan, and make a deposit of the desired amount in your account via the appropriate payment method.

You`ll find the onboarding videos while start your registration on the platform.

Trading and management commissions are specified in the pricing plans and will decrease as your trading deposit increases.

Yes, for investments over $50,000, we offer personalized strategies tailored to your risk tolerance and individual financial objectives.

While success varies by strategy and market conditions, Alvia’s historical data demonstrates consistent profitability with a track record of outperforming benchmarks.

You can get in touch with our team via the contact form on its website or just text us at support@alvia.com

Grow your wealth together

Expand your network - scale your income.

Please fill in the correct contact details

Grow your wealth together

Expand your network - scale your income.

Please fill in the correct contact details

Alvia provides asset management services using proprietary algorithmic trading strategies and does not offer direct trading platforms. Investing involves financial risk, and past performance does not guarantee future results. Losses may occur due to market conditions, technical failures, or economic downturns.

Alvia does not operate in jurisdictions where its services are restricted, including the United States, Canada, Japan, Brazil, the European Union, and high-risk regions identified by FATF.

Users are responsible for ensuring compliance with local laws, including tax obligations.

By using Alvia, you accept all associated risks and acknowledge that investment decisions are your sole responsibility. Personal data may be processed and shared with third-party service providers as outlined in our Privacy Policy and Terms & Conditions.

Affiliate | Bridge | Dashboard | Trading Performance